Government authorities across the world today play a crucial role in facilitating efficient trade across international borders. The revenue and tax authorities deal with all kinds of cargoes but those that require more effort and attention are bonded transit, hazardous and high value cargoes. As these cargoes move from one location to another, the authorities would inevitably be faced with a range of potential challenges.

Challenges

- Tax Revenue Leakage: Cargoes declared for transit are susceptible to diversion and import tax evasion through the tampering of bonded cargo while in transit.

- Lack of Compliance: There is a high incidence of bribery of authorities at custom checkpoints

- Inefficiency: Cargo inspections increase lead time for customs clearance. Serious traffic congestion between ports. Manual record keeping of shipments.

Given the challenges faced by the tax and revenue authorities, it is evident that if these problems persist, it would generate inefficiencies and in the long run, pose a negative effect on countries’ economic growth. As such, an Electronic Cargo Tracking System has been increasingly adopted by authorities as it helps them to solve security, compliance issues, reduce manpower and increase tax collection.

In this article, we will be exploring how the features of an Electronic Cargo Tracking system can help tax and revenue authorities to ensure compliance, enforce proper taxation and encourage greater time efficiency at custom checkpoints.

Features of an ECTS

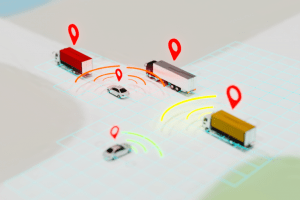

Unlike a Fleet Management System, an Electronic Cargo Tracking System (ECTS) focuses on the cargo itself. An ECTS has the ability to secure and track cargo across international borders.

- Trip Based Tracking: Real time location tracking of cargo, security and environmental tracking of bonded and transit cargo.

- Route Deviation Alert: Deviation alerts notifies the diversion of bonded cargo in transit.

- Real Time Tamper Alert: Get notified when bonded and transit cargo are tampered with.

Overall, an Electronic Cargo Tracking System has simplified the work processes for government authorities. Not only do they get peace of mind now that they gain real time visibility of cargoes across borders but they also get to ensure security, enforce proper regulations and improve time efficiencies of tedious processes. As we forecast into the future, an ECTS would undoubtedly help to save time, manpower costs, increase tax revenue and in turn, boost the economic growth for many countries especially landlocked countries.

Invest in an ECTS to help simplify bonded and transit cargo processes. Rock Africa’s Electronic Cargo Tracking System promises to provide end-to-end solutions that aims to optimise security and streamline operational processes.